Divestment at the U Would Spark a Renewable Energy Revolution

by Jonathan Park

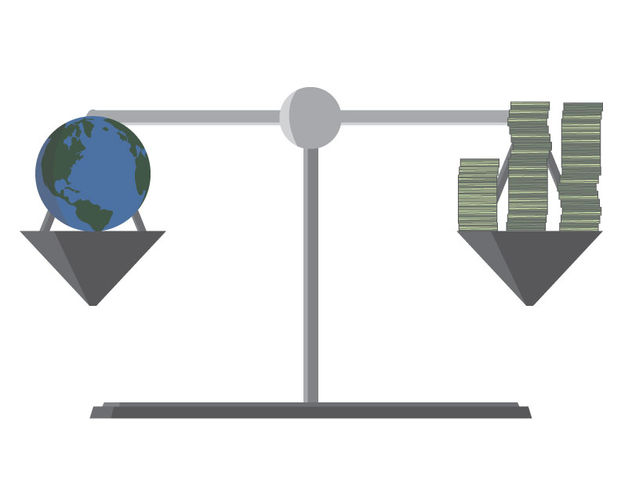

You know the old adage ‘money makes the world turn’? When invested irresponsibly, money also has the power to make the world burn. Manmade greenhouse gases (GHG), generated by burning fossil fuels, are heating things up too much, too fast. Unless we can drastically reduce our global GHG emissions, scientists predict this kaleidoscopic marble we call Earth will no longer be hospitable merely centuries from now. If we are to preserve our sweet slice of the universe and continue our existential experiment, we need to wean off our dependence on fossil fuels — and fast. The U is currently grappling with its role in this crisis and is trying to determine how to best invest in its own future, while simultaneously helping to secure a better, more sustainable tomorrow for humanity.

Divestment is the process of withdrawing investments from certain companies in an effort to promote particular policies or behaviors. While divestment has been wielded to further a wide array of social and environmental issues, the most well-known example came in response to apartheid in South Africa. Large investment firms and mutual and retirement funds collaboratively unloaded the stocks of companies who did business there. It generated so much public pressure that the South African government eventually buckled, ending its long-standing racial segregation policies.

Today, a similar divestment movement, aimed at combating climate change, is sweeping colleges and universities across the globe. The goal of the movement is to apply public pressure to the fossil fuel industry and hold it accountable to reality — an immediate and irrefutable need to drastically reduce global GHG emissions. The U is considering a number of strategies for approaching fossil fuel divestment.

The U’s endowment fund holds about $1 billion, with roughly 50 percent presently invested in stocks. The Academic Senate Ad Hoc Committee on Responsible Investment (CRI) was created in order to inform the U’s endowment managers on socially responsible investing and to weigh the pros and cons of fossil fuel divestment. While the committee has yet to release its final recommendation on divestment, it has conducted some illuminating research.

Most large investment firms now offer a variety of products and services that make it easy for consumers to find Socially Responsible Investments (SRI). They can also help people avoid misusing their money by screening for certain criteria. Using four different SRI products that represented a variety of investment restrictions based on social and environmental concerns, the CRI looked at how differing degrees of fossil fuel divestment would likely affect the endowment fund’s bottom line. After back-testing the U’s endowment portfolio by substituting the performance of stocks held over the past 10 years with the performance of those various SRI funds, the committee found that fossil fuel divestment could cost the U anywhere between $1 and $22 million a year. The reason is simply because limitations imposed on your investment strategy are likely to reduce your return on investment per unit of risk. Additionally, the fees associated with these relatively new SRI products are much higher than those of standard investment options.

Unless you’re Donald Trump, it’s hard to call millions, and potentially tens of millions of dollars, chump change, but in this case, it really is. The U’s endowment fund only generates about four to five percent of the university’s total operating costs, and fossil fuel divestment would only reduce those earnings by .001 to .022 percent, according to the CRI’s models. Furthermore, there is reason to doubt that divestment would carry any adverse expense at all in the long run. SRIs over the long term that opt for renewable energy firms over fossil fuel companies will fare better. Historically speaking, returns on fossil fuel investments are on a sharp downward trajectory, while returns on renewable energy investments are climbing. It’s getting more expensive to extract fossil fuels and, as more countries adopt responsible climate change policies that put a higher price on carbon emissions, it will also grow less profitable to do so.

Global equity markets hold around $200 trillion, whereas the amount of money represented by the divestment movement is a relatively small $50 to $500 billion. Thus, opponents of divestment argue that universities simply don’t have enough cash to make a significant impact on the bottom line of the fossil fuel industry. Do you think the patriots who participated in the Boston Tea Party gave a damn how much their act of defiance hurt the East India Company’s bottom line? It was more a symbolic gesture, and though it didn’t bankrupt the tea business, it inspired a national revolution. The purpose of divestment is not to bring the fossil fuel industry to its knees, but rather to grab it by the ear and tell it that we are ready for a renewable energy revolution, not because fossil fuels are inherently bad but because they are presently posing a risk to all that is inherently good: breathable air, clean water, productive soil, snow-capped mountains and life itself. If we are to conserve the things that matter to us most, we will need to develop clean, sustainable energy, but that won’t happen unless we take immediate action. By divesting from fossil fuels, the U would be standing up against the irrationality of an economic system that is suicidally obsessed with making money. I think the symbolism of that gesture is well worth the slight financial costs that could be temporarily incurred as a result. If you disagree, just ask the residents of Flint, MI whether saving a few extra bucks on their city’s water management was worth it.

High Cost, Low Return of Divestment Not Worth It

by Emma Tanner

The issue of climate change hasn’t exactly been on the political forefront lately, but it remains a looming issue. And if we want to protect the well-being of our planet, investments in alternative forms of sustainability should be pursued sooner rather than later. But people often are more concerned about life in the here and now than in the decades to come, so the immediate economic implications of investments into safer forms of energy have seemed irrelevant and not worth the money and resources now necessary for advancement in the eyes of many companies, institutions, political figures and individual people. Does the U, as a public institution, have a responsibility to set an example and devote more of its resources and agenda to supporting the research and development of energy sources, replacing harmful fossil fuels? Should the U commit to the “divestment movement,” where universities are now seeking to spread awareness of climate change and end relationships with fossil fuel companies?

There are reasons that the use of fossil fuels have yet to be abandoned — reasons beyond public ignorance. In this day and age, companies around the world rely on fossil fuels for production. The financial expenses behind abandoning this production input would prove difficult to reconcile while supporting other production factors like employment and maintaining a functioning business. But fossil fuels are a finite resource, and as they become scarcer, they become more expensive, allowing for an easier transition into relatively cheap sustainable alternatives over time.

But for now, fossil fuel is a huge global resource that is, according to Duncan Clark of the Guardian, “enormously useful, massively valuable and hugely important geopolitically.” Fossil fuels still play a major role in our global economy and are the reason many less-developed countries can stay afloat when they lack other options for state revenue, namely Middle Eastern countries and their oil extractions. These are points most nations acknowledge when they consider unsafe pollutants and, for the most part, people have given up on their common sense to push aside the dangers of fossil fuel emissions because of the economic returns and associated quick increases in the standards of living propelled by the uses of fuel in production.

And, interestingly enough, when looking at a graph produced by scientists from Lancaster University in 2012, our efforts to decrease pollution emissions in the last decade haven’t done anything.

The growth rate of carbon emissions in the world is still around the same percentage as it was in 1850 — two percent each year. This is largely because where some places have invested in wind turbines and Priuses, others have increased their uses of fossil fuels to instigate the development thereof. And while the U.S. boasts that, under President Obama, our nation’s carbon emissions have declined, our government still encourages the pursuit of fossil fuels and fuel exportation to other developing countries, which, in the grand scheme of things, doesn’t do much good for our planet.

If climate change is going to be taken seriously, we’re going to have to do more than commute to work on a GREENbike or have a few universities support divestment into fossil fuels. But that doesn’t mean that the U can’t take some part in supporting this massive global transition and educating relevant generations. The U, along with other educational institutions, has a relevant voice in the global conversation concerning climate change. Complete fossil fuel divestment might be too extreme of an action to take at this time. There has been talk, however, by people like undergraduate student Eric Hendey of Harvard’s Institute of Politics, suggesting that universities divest from, for example, coal only, as it is considered a more harmful fossil fuel to human and animal health, as well as the environment. This would allow for a serious example to be set by large public institutions to support the transition into alternative sustainable forms of energy without participating in fossil fuel divestment completely. It’s a good start that the U might want to consider following.