WASHINGTON, D.C.8212;In a surprising series of developments, the U.S. House of Representatives struck down a $700 billion bailout of the banking industry in a vote of 228 to 205 Monday afternoon.

Republicans were the most decidedly against the bill with nearly one-third of GOP representatives voting in favor. Nearly 60 percent of Democrats voted to favor the bill. Supporters of the bill hope to bring up a new vote as early as Monday night or as late as Thursday.

The bill failed despite support from President Bush, presidential candidates Sen. Barack Obama and Sen. John McCain and bipartisan Congressional leaders.

A White House spokesman said Bush was very disappointed with the results of the House vote.

“There’s no question that the country is facing a difficult crisis that needs to be addressed,” said spokesman Tony Fratto.

Christopher Frenze, Republican staff director for the Joint Economic Committee, said whichever candidate wins the presidential election will have to deal with the repercussions of this problem regardless of whether or not a bill is passed.

“The next president is going to have to continue to address this problem,” he said. “This plan is not going to be a silver bullet where all of this goes away. It is going to be a big problem in the future.”

Republican congressmen blamed the bill’s vote failure on Democratic Speaker of the House Nancy Pelosi of California. Republicans said remarks made by Pelosi immediately before the vote made it impossible for them to vote in favor of the bill. Pelosi said the current economic crisis was the fault of the Bush administration and hands-off government policies in business.

Utah Reps. Jim Matheson, D-District 2, and Rob Bishop, R-District 1, voted against the bill. However, departing Rep. Chris Cannon, R-District 3, voted in favor of the bill.

Many congressmen felt pressure from their constituents to not support the bill. Angry callers told Cannon’s office they do not want to pay more taxes to benefit the wallets of banking owners and radical investors.

In a statement issued by his Salt Lake City office, Matheson said he was against the bill because it placed too much burden on the tax payer and not enough emphasis on government reform.

“Utahns are outraged that even as they try to cope with a weakening economy, Congress wants them to come to the rescue of big banks who contributed to this financial mess,” Matheson said.

However, Frenze said there might be confusion about the bill and about the $700 billion price tag.

Frenze said the proposed bill would only allow the Treasury to borrow money8212;not raise it from taxes8212;and then buy unwanted packaged mortgages at a discounted rate from participating firms. This means assets worth $700 billion would be bought for a much lower price.

“It would cost less than $700 billion,” he said. “It is unfortunate that it looks like there is a $700 billion price tag. It is possible on some of these assets the government could actually make a profit.”

Ashley Swan, a senior in mass communication, said she was surprised the bill did not pass and expressed concern about what would happen if there is not a solution soon.

“It should not be about a few people complaining about tax payers making up the difference for a few people’s mistakes,” Swan said. “This affects all of us and something needs to be done. If not, we will never get out of this mess.”

Despite his vote in favor of the bill, Cannon expressed frustration with Congress in an interview Friday. He said the ways the bill was written and presented before Congress were problematic.

“This crisis has turned into a bit of a sideshow,” Cannon said. “It is all posturing instead of public debate. It is posturing because the discussions are going on between a few people in a room instead of many people on the floor of the House.”

Cannon said the lending market is already in a difficult position and would get worse with time.

Frenze said those that would be most affected are those already with a credit card balance in American businesses.

“Small and large business will have a harder time expanding. It will be harder for a person to find a job and the general state of the U.S. economy would be much weaker than it otherwise would be,” he said.

Regardless of whether or not a bill is eventually passed, Cannon remains optimistic. “This crisis will pass,” he said. “I hope. I really hope. But I don’t think it will pass with the clarity it should pass. If we are not careful the crisis will be elongated from months to years.”

Editor’s Note8212;Jed Layton is reporting from Washington, D.C., through the Hinckley Institute of Politics and Shantou University Journalism Program.

Associated Press

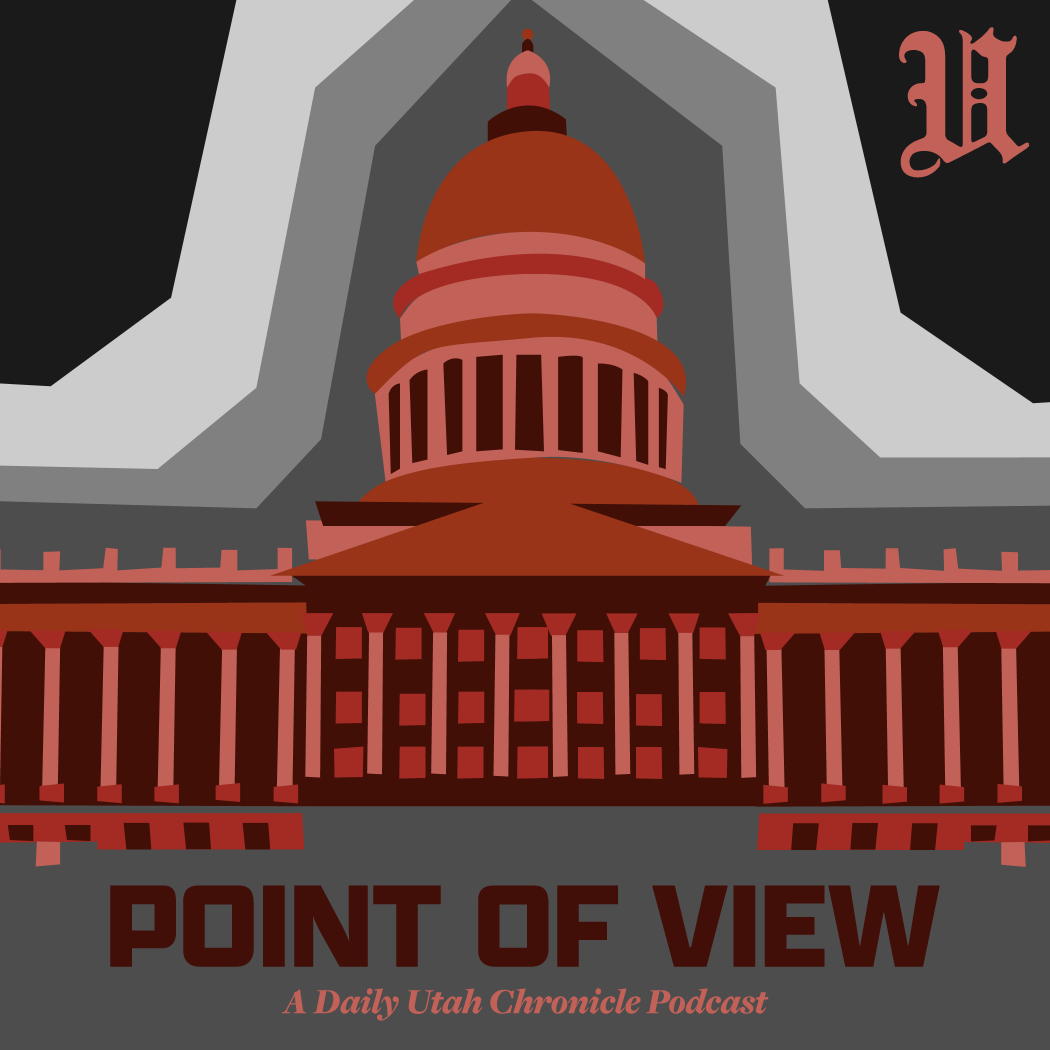

Associated PressMembers of the House Democratic Leadership, House Majority Leader Rep. Steny Hoyer, D-Md., House Speaker Nancy Pelosi, Rep. Rahm Emanuel, D-Ill. and James Clyburn, D-S.C. meet with reporters on Capitol Hill in Washington.