Barron: Referendum Efforts Send a Signal to State Representatives

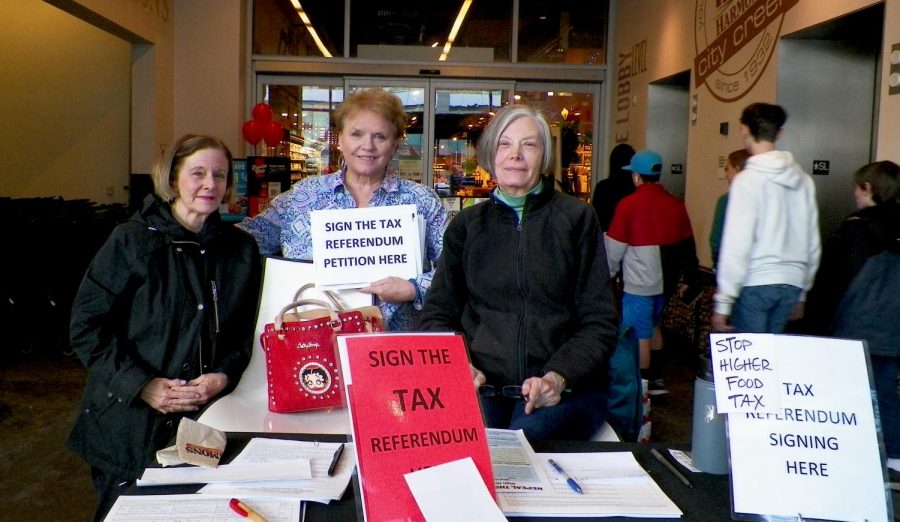

Mary Miller, Colleen Basam Taylor and Carolyn Wavrin stand in Harmon’s to collect signatures for a petition against tax reform. (Photo by Hailey Danielson | The Daily Utah Chronicle)

February 2, 2020

Last December, Governor Gary Herbert called a special legislative session to debate massive reform to Utah’s tax system. The proposed bill would have hiked the sales tax on groceries from 1.75% to 4.85% while cutting the income tax and increasing per child exemptions. The legislature passed the controversial bill and Herbert signed it into law, but it failed to secure a two-thirds majority vote, and was later overturned by a citizen referendum with around 145,000 verified signatures. (The exact number of signatures is still undetermined.)

The plan’s critics ranged from anti-poverty advocates to educators to Republican gubernatorial candidates to members of the business community. Several organizations volunteered their resources to put a referendum on the 2020 ballot. Utahns stood up against deficient tax legislation and showed their representatives that they want funding for education and for families to be able to afford their groceries.

In the past, state leaders have been all talk and no action when it comes to prioritizing education. Utahns already made education a priority in the state constitution by requiring revenue brought in through state-level income taxes to fund public education. Yet Utah continues to be dead last in per-student educational spending and is currently experiencing a teacher shortage, which is unsurprising considering the laughably low educator salaries. Instead of drafting legislation to increase educational funding, the legislature gambled on passing income tax cuts, leaving public education with a $600 million IOU.

Lawmakers may believe that the education funding guarantee is tying their hands when it comes to the state’s overall budget, but research shows that an educated population ultimately results in higher tax revenue. A highly educated workforce also strengthens the local economy by attracting employers and creating innovative products. Utah’s PTA understands how funding impacts the quality of education and threw its support behind the referendum, declaring the now-failed attempt at tax reform “a threat to the long-term funding of education in Utah.”

Volunteers who joined in a grassroots referendum effort in the name of education sent a strong message to state representatives. Over the upcoming weeks, lawmakers are expected to consider an amendment to the Utah constitution allowing revenue raised by the income tax to be diverted from education to other state expenditures. By making their support for educational spending known, voters have protected Utah’s education system by decreasing the political will to pursue this amendment.

Utahns believe in taking care of families. As gubernatorial candidate Aimee Newton Winder noted, “Sometimes what looks good on paper isn’t always what’s best for real Utahns.” The tax credit would have only been provided on an annual basis while the increased sales tax would affect every trip to the supermarket. For some Utahns living paycheck to paycheck, this difference would be a deciding factor in having to choose “between a gallon of milk or diapers for their babies.”

Harmons Neighborhood Grocer, a Utah supermarket chain, echoed this sentiment and hosted referendum advocates in its 19 Utah locations. Bob Harmon, chairman of Harmons, said the company decided to join the referendum campaign because they do not believe groceries should be taxed as “food is essential and should be affordable.” Collecting signatures at a local grocery store was critical to the referendum campaign because it allowed advocates to discuss with shoppers how the tax plan will affect their grocery bill.

Just two days into the session, the legislature repealed the tax reform legislation. Hours later, Herbert signed the legislation and commended “the many legislators and people of Utah who participated so fully in this process.” Aspects of the tax reform bill would have a positive effect on the state, including increased taxes on luxury services and the repeal of Utah’s “tampon tax.”

However, to paraphrase a leader of the referendum movement, sprinkles on crap doesn’t change that it is crap. The grassroots campaign against the tax reform bill has shown state leaders that Utahns will not be appeased by small concessions to the community when the cost is an underfunded educational system and hungry families, a message heard loud and clear on Capitol Hill.