I lived in rural West Virginia for part of 2017. I ate my first “proper” biscuit, attended a bluegrass concert in a cave and came home with a slight southern drawl. During my stay, I spent plenty of time driving through the Appalachians to make weekly trips to the closest Walmart, well over an hour away, or to explore “Wild, Wonderful West Virginia.” Roadkill was a casualty I expected on mountain roads, but I was startled to discover another casualty framing Route 60; mining towns.

Since 2008, West Virginia’s coal production has decreased 50 percent, and as the state’s main industry collapses, so does the population. While President Donald Trump claims lifting government restrictions and ceasing the so-called “war on coal” will reinvigorate the American coal mining industry, inexpensive energy alternatives such as Australian coal or natural gas have made it impossible to reverse the overall decline of coal mining in the United States.

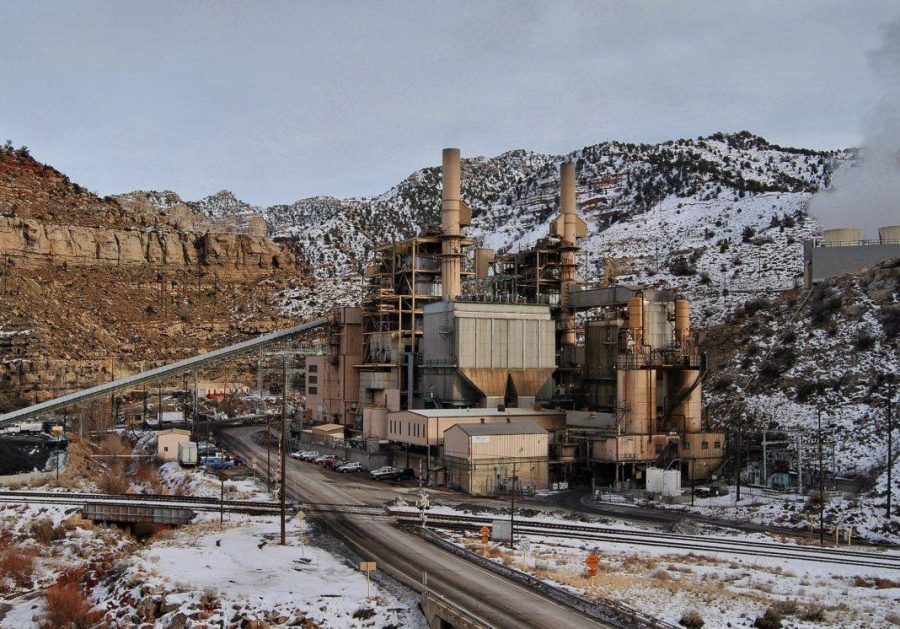

Utah’s coal mines have not been immune to this national trend. Coal production has decreased 25 percent since 2005. However, mining companies continue to employ about 64 percent of residents living in “Coal Counties,” Carbon, Emery and Sevier Counties, and annually generate millions of dollars for the state in royalties and taxes. Seeing only the current coal revenue for Utah and unable to understand the long-term projections for the coal industry, State Representative Mike Noel is petitioning the state of Utah to sue the state of California over their cap-and-trade program which utilizes market forces to reduce statewide emissions. The motion for summary judgment, led by Alton Coal Development, is estimated to cost the State of Utah $2 million. If the suit goes to trial and there are appeals, the cost would increase dramatically. Instead of bankrolling a legal battle for a diminishing industry, the Beehive State should invest $2 million dollars in adapting our energy industry to fit market demands and employ those who have been or will be impacted by the continued decline of the coal industry.

In 2017, the Office of Energy Efficiency and Renewable Energy released a report detailing return on investment the United States Government experienced in renewable energy research and development. The total taxpayer investment of $12 billion has yielded more than $388 billion in net economic benefits in the United States, almost 3000 percent total increase and an annual 30 percent increase. If this return on investment trend held for Utah investing in renewable energy, the state could expect an annual increase of $600,000 the first year. While this may seem incomparable to the millions in royalties Utah receives from coal companies, it provides a more sustainable source of income to the state and will create jobs.

Sitting at a picnic table in the Kanawha State Forest, a native West Virginian who had taken a job in Ohio told me, “You either bemoan the war on coal or you leave. Ain’t nothing else left for you here.” Gratefully, Utah has a diversified economy and therefore has a future beyond coal. Cap-and-Trade has survived previous lawsuits and will most likely survive Alton Coal Development’s as well. We should not waste resources fighting the “war on coal” as no amount of lawsuits will prevent time and technology from replacing Utah coal with environmentally friendlier options. $2 million better serves Utahans invested in modernizing our energy industry to replace dwindling coal jobs.