In the genesis block of Bitcoin, a message was left in the parameters by Satoshi Nakamoto, a pseudonym for the mysterious and unknown creator(s) of Bitcoin. This message reads:

“The Times 03/Jan/2009 Chancellor on brink of the second bailout for banks.”

Back then, cryptocurrency and blockchain were obscure terms known only in small cryptographic message boards and chatrooms. These early adopters understood the implications of building a decentralized network as a means of storing currency with the help of cryptography and a distributed network of nodes which vie with one another to process transactions. The idea behind the ideology is simple: Blockchain technology gives individuals the ability to create their own decentralized digital currencies — opening up the possibility for anyone to trade and store their finances without the need for banks, governments or intermediaries. The decentralized nature of cryptocurrencies embodies the spirit of a true free market, whose supply and trade cannot be regulated by any government nor any other authority. The irony is that the series of bank bailouts that inspired Bitcoin came about when many banking regulations were loosened in the world. When the markets become less regulated, bad actors always seem to pour out of the woodworks to abuse the generosity of the free market. Cryptocurrency is no exception to the rule, becoming a mecca for fraudsters, market manipulators and dark-market criminals that thrive in the brittle structure of an unregulated market.

Abusing the Free Market

Without a regulatory body to prevent or punish bad actors from exploiting the cryptocurrency market, communities run rampant with corruption, fraud and market manipulation, causing U.S. financial regulators to issue dozens of warnings to American investors and consumers. Common market manipulation tactics that are normally impossible to get away within a traditional financial market are the norm in cryptocurrency. Schemes such as “pump and dumps”, where one investor or a group of investors “pump” value into a particular cryptocurrency to artificially increase its value and create public hype only to “dump” it after, are incredibly common in the unregulated crypto market. ICOs (initial coin offerings) are events in which a startup company seeks out crowdsourced funding via cryptocurrency for their “decentralized” business ideas. Usually a company will implement their own cryptocurrency (or token) into their platform and promise huge returns on investment if their platform is a success. Amateur investors shelled out approximately $6.3 billion dollars worth of cryptocurrency to startups in 2018 during their ICOs. Sadly, participating investors rarely do the due diligence required to make educated investment decisions and, as a result, many of these companies turn out to be shell corporations and fraudulent ventures aimed at “exit scamming” ignorant investors. Ethereum, a cryptocurrency with smart contracts (programmable financial contracts) has had hundreds of millions of dollars stolen out of various smart contracts that were improperly programmed by their authors. Globally, $1.1 billion dollars worth of cryptocurrency was stolen within this year alone. It is literally impossible for any individual or authority to pursue stolen or defrauded funds since the networks that cryptocurrencies exist upon are entirely decentralized.

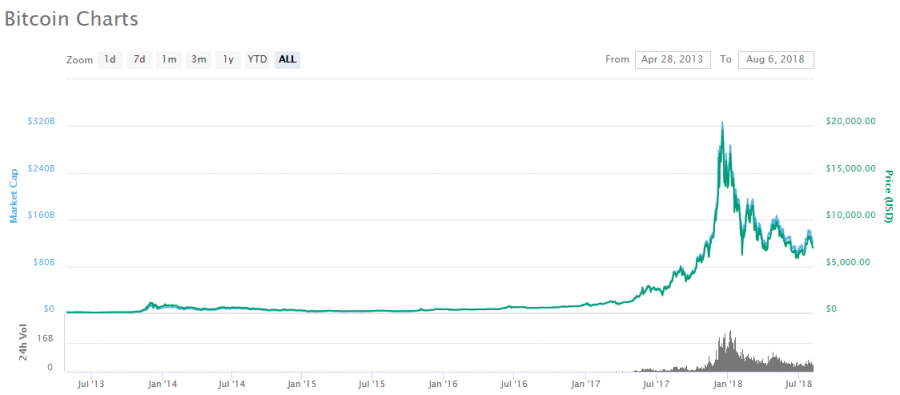

Unsubstantiated good or bad news can cause any cryptocurrency or the entire market to lose or gain 20% in value. False or dishonest information released to the public is known as FUD (fear, uncertainty and doubt) in the crypto community and is constantly spread by actors trying to manipulate markets in their favor. The concept of FOMO (fear of missing out) also plays a role in how the crypto markets behave. Anytime Bitcoin prices rise, investors will jump into the market trying to chase the rising value only to have the market drop again with many chasing the sell-off. The list of thriving bad actors and criminal activities within the cryptocurrency sphere seems to never end:market manipulation groups (who made $825 billion dollars this year alone), terrorist organizations and sanctioned states, firearm and child sexual abuse materials (CSAM) markets, massive ponzi schemes, insecure cryptocurrency exchanges losing billions and high-level celebrities endorsing fraudulent cryptocurrencies.

Many early adopters of cryptocurrency were libertarians with a dream of economic freedom for all, but as soon as the value of Bitcoin ballooned, millions of people flocked to the digital commodity out of self-interest rather than ideology— which created an explosively volatile market ruled by an emotional and irrational mob of amateur investors with a weak loyalty to the libertarian ideal. The market volatility also comes from the highly-speculative nature of crypto markets. Literally no one knows the true value of the technology, yet while stock prices are governed by the performance of a company and government currency exchange rates are governed by the performance of a country, investors have no metric to estimate the real world value of Bitcoin yet.

A Flawed Ideology

Bitcoin has been heralded as the next evolution in currency and the death of the state. Its central goal is to seize control of currency away from monolithic financial institutions and put it into the hands of the people. The major flaw in the ideology of cryptocurrency is that it revolves around far-right economics: it pretends that the only problem with our current economic system is the centralization of the currency/market control and not with the economic structure itself. The supply of cryptocurrency is more unequally distributed than any government-backed currency. The Gini coefficient represents the distribution of wealth in any particular group of people, with 0.0 being the most equal distribution of wealth and 1.0 being the most unequal distribution of wealth. The U.S. has a Gini coefficient of 0.39 (4th highest in the world) and Bitcoin’s Gini coefficient is estimated at 0.65 to 0.88, which is almost twice as high as the top nation in the world. The wealth redistribution created by Bitcoin is incredibly unfair. In the first few years of Bitcoin, early adopters were given huge payouts to mine Bitcoin (process transactions). Anyone could set up their personal computer to begin mining and would be millionaires today if they kept their Bitcoin. Over time, however, Bitcoin is designed to become exponentially harder to mine in order to “deflate” the currency. Mining Bitcoin has become so difficult only those who are wealthy enough to afford warehouses full of computers dedicated to mining (which uses an unbelievable 0.5% of the world’s electricity) are able to make a profit. Ultimately, the hardcore Bitcoin ideologues have no plan or goal to redistribute wealth to the common people beyond what is being redistributed to those who can already afford to take a risk and invest or mine in Bitcoin. This has inevitably led to just a few hundred people holding a majority of the Bitcoin supply (known as whales) and spawned what are essentially centralized mints that control the Bitcoin network— highlighting the absolute irony of the flawed economic theory of cryptocurrency in its current form.

Bitcoin’s ideological roots are a fundamentally wrong understanding on how power becomes centralized and how wealth inequality is created and maintained. The problem with our current economic system isn’t who is in charge of the currency supply or markets— the real problem is the economic system itself, which allows for a grotesque level of centralization in wealth and capital. Nine people in the world own more wealth than the poorest 4,000,000,000, and cryptocurrency has no plan or ability to stop people from accumulating that much wealth if it were made our global currency. Crypto has no ability to stop the centralization of wealth, nor prevent the increasing wealth gap in those who provide labor versus those who provide capital. When the time comes, it won’t even have the ability to prevent big financial firms from entering the Bitcoin market, which could create the same exact mess Satoshi was hoping to prevent. Soon, it will be Bitcoin’s 10th birthday, and though the value of one Bitcoin is currently oscillating around the once unbelievable price of $7,000 USD, we are still no closer to cryptocurrency becoming the financial liberator Satoshi had hoped it could be. Instead, cryptocurrency has become an incredibly lucrative vehicle for bad actors. With no central authority in charge of stabilizing the value of Bitcoin or preventing economic disaster, the crypto market collapsed this year in the tune of losing 70% of its total market capitalization (~$600 billion dollars) since its high last December.

Tvilleman • Jun 12, 2021 at 7:13 am

What is your take on BTC now? And cryptography/cryptocurrency?

Thanks