In the 1980s, University of Utah students called for the U to divest from apartheid. To them, this meant halting the university’s investments in companies that were funding apartheid in South Africa. In November 2023, U student organization Mecha demanded the university “cut all ties with Israel,” by pulling out investments into “war profiteering companies.”

The U has a complex investment strategy involving different “pools,” each with different holdings and a different purpose. As a public university, they are subject to institutional disclosure requirements, which involve making aspects of their financial information accessible to the public.

Mecha cited the U’s recent financial partnership with 47G as evidence of their support of Israel. The U announced its partnership with the organization on Oct. 13, 2023. Here is what the research shows.

Aerospace and Defense Investments

47G, a new brand of the Utah Aerospace and Defense Association, started working with the U two years ago.

The statement announcing the partnership says 47G “is rooted in the human drive to explore new frontiers on earth and in space.”

University Communications Manager Shawn Wood said the U currently pays $50,000 in annual member fees to be part of the 47G board. In fall of 2024, the U will be co-sponsoring a summit with the company where the university investment will be $100,000.

“To be clear, these expenditures are paying membership dues and supporting event sponsorships,” Wood said in a written statement. To date, the U has paid $100,000 in membership fees and will be paying $100,000 for the event in the fall, according to Wood.

The partnership is based on “key research strengths” of the university, which Wood lists as “digital twinning, additive manufacturing, cybersecurity, space exploration and health research.”

Wood said the health research category includes programs like blast injury recovery, suicide prevention, long term radiation effects and pilot health and wellness.

“The University of Utah does not have a significant weapons research portfolio, so our relationship with 47G focuses on our research strengths,” Wood said.

While the U’s specific relationship with 47G may be research-based, some of the group’s other members are defense companies, including Raytheon and Northrop Grumman. Both companies have been the target of pro-Palestinian protests due to their role in selling weapons to Israel in the ongoing Israel-Hamas war.

The American Friends Service Committee compiled a list of companies that are profiting from Israel’s attacks on Gaza. Raytheon and Northrop Grumman are on the list, as well as Boeing, another member of 47G.

As one of the world’s top weapons manufacturers, Northrop Grumman has supplied the Israeli Defense Forces with multiple weapons, including the “longbow missile delivery system” for Israel’s attack helicopters and a “laser weapon delivery systems for its fighter jets.” Northrop Grumman also provided Sa’ar 5 warships to the Israeli Navy.

The Utah System of Higher Education is listed as a member of 47G, which includes Utah State University, Utah Valley University, Weber State University, Ogden-Weber Technical College, Salt Lake Community College, Southern Utah University and the U.

How Do the U’s Investment Pools Work?

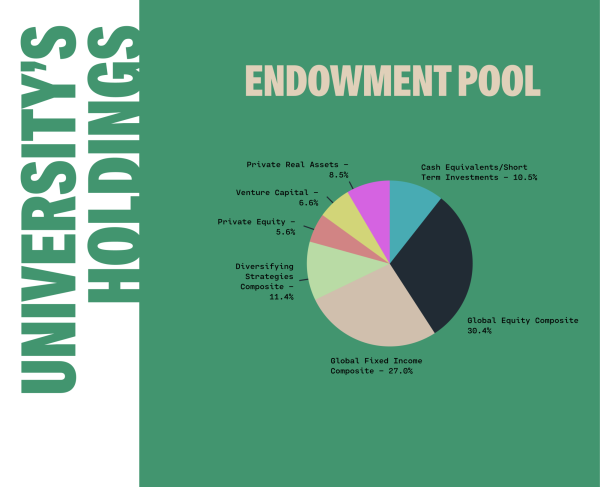

According to the U’s January 2024 monthly investment report, the university currently has six financial “pools.” These pools are cash management, funds separately invested, bonded debt investments, endowment, Hinckley and social choice.

The cash management pool makes up 48.2% of the U’s entire portfolio and is valued at nearly $3 billion. This pool includes holdings like operational funds in cash equivalents and U.S. Treasury notes.

The U’s endowment pool is valued at approximately $1.6 billion, making up the second-largest portion of the U’s total portfolio. Endowments are typically comprised of funds that are donated to a university and then invested for growth purposes. The endowment at the U has the majority of its holdings in private equity and venture capital investments.

Universities often take large positions in one publicly traded stock. For example, Yale University has almost 79% of its $113 million stock portfolio in grocery chain Albertsons. Massachusetts Institute of Technology has about 86% of its $539 million stock portfolio in Coupang Inc., a consumer goods company. Comparing this to the U’s endowment pool, the biggest difference is that most of the U’s investments are alternative investments.

What are Alternative Investments?

Alternative investments, also sometimes referred to as private investments, are investments that do not fall into the classic stock or bond asset class. Alternative investments can include commodities, real estate, venture capital, private equity and more.

The U invests significantly in venture capital and private equity funds. These funds manage and contribute to multiple businesses as investors and make a profit from their successes.

As an investor in these funds, the U recognizes investment gains when firms can successfully create returns on their investments in their backed companies. These funds can have anywhere from three to hundreds of businesses involved.

Venture capital is similar to private equity, except the businesses that a venture capital firm invests in are often startups or smaller companies, whereas private equity is typically investment into more established businesses.

The Endowment: Oil, Gas and Pharmaceuticals

According to the U’s quarterly investment report on the endowment pool from December 2023, the U’s venture capital and private equity selections profit came from investments into oil, gas and pharmaceuticals, including Pine Brook Partners and Cross Creek.

Pine Brook Partners is a private equity firm that works with companies like Admiral Permian Resources , Accelerate and Pursuit Oil and Gas. What these companies have in common is their profit lies in the ownership and development of global oil and gas property and resources.

Cross Creek, another private equity firm home to a fund held within the endowment, invests in several pharmaceutical companies. This includes Rules Based Medicine, which uses biomarkers to assist drug development, and Orexigen Therapeutics, a company that sold a weight-loss drug before filing for bankruptcy and being acquired in 2018.

“We have lots of people who have very strong feelings about our overall investment portfolio,” Wood said. “… We invest our money in both oil and gas, because that provides high yield returns for faculty and staff, and that goes into our endowment that then supports students. … If they think that this one company is particularly evil, that’s fine, I don’t know that the university would necessarily agree that we are funding a genocide.”