Americans are in an uproar over the use of money from the American International Group’s recent bailout. After the company’s financial collapse, which was at the heart of the economy’s tailspin, AIG received more than $170 billion from the government. Most of that money has already been spent, and the latest tumult is over $165 million divvied out in executive bonuses. But among the chaos and the dishonesty, why is this surprising?

In fact, this $165 million is only the tip of the iceberg with AIG. There are literally billions of dollars unaccounted for. An estimated $62 billion has been invested overseas, buried in foreign markets and even used as secondary bailouts for unintended recipient corporations.

Similarly, other recent government bailouts have been used precariously and unethically, and every time, Americans are left with a sense of confusion and betrayal. I can’t for the life of me understand why. Let’s take a quick tour of the moral high ground we’re walking on with some of the corporations we’re bailing out.

Ford, one of the primary beneficiaries of the 2008 auto industry government bailout, hasn’t exactly had a history of ethical executives. Take an older example: the Pinto that Ford manufactured in the 1970s. The car had a defective gas tank that could burst, spew gas and burn passengers to death. Installing a simple piece of plastic would have fixed the problem, at a cost of just $11 per car. However, for the 11 million cars and 1.5 million light trucks manufactured, the total cost of installing the safety unit would have been $137 million, according to “Benefits and Costs relating to Fuel Leakage,” Ford’s internal memo on the Pinto. In this memo, executives compared these costs to the costs in benefits paid to burn victims and relatives. Experts figured 180 burn deaths would result if the unit wasn’t installed, plus 180 serious burn injuries and 2,100 burned vehicles. At $200,000 per death, $67,000 per injury and $700 per vehicle, the total cost in benefits would be $49.5 million. Executives were faced with a

tough decision8212;manufacture a car that doesn’t burn people alive, or save an estimated $87.5 million and set a few hundred people on fire.

They chose money. Hundreds of people burned to death, and many others were permanently disfigured. Ford was formally accused. Ford was acquitted. Ford issued a recall for the Pinto, along with a publicity campaign to maintain their image of a company based on American family values. No Ford executives were ever tried in court8212;despite causing hundreds of deaths, they suffered virtually no consequences.

If you thought that example was outdated and irrelevant, take a look at General Motors, which did a very similar cost-benefit analysis in 1998 with the Oldsmobile Cutlass, resulting in more deaths and more lawsuits. Similarly, no executives were tried, just the corporation itself.

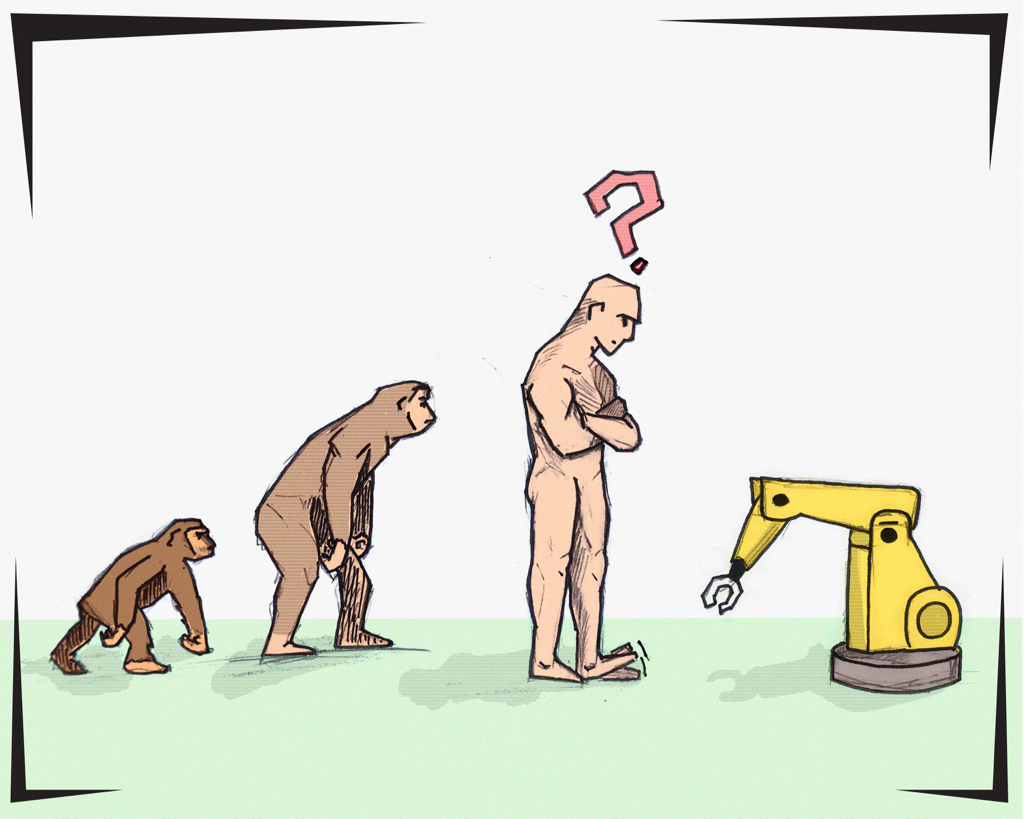

The separation of the individual from the corporation contributes to an “it’s just business as usual” attitude. There is virtually no sense of responsibility, and as such, extremely immoral financial decisions are being made. We’re trusting the very GM executives mentioned above, along with many others with equally appalling histories, with billions upon billions of taxpayer dollars. What do we expect to happen?

We gave $160 billion to AIG. They’re not interested in stimulating the economy, they’re interested in a simple cost-benefit analysis, similar to the one GM or Ford ran. They could spend $80 billion to bolster their securities lending business, as they were entrusted to do, or they could spend $60 billion to post collateral with other financial institutions. They choose foreign investments, call it a secondary bailout, and take steps that could bury the company. And while they’re at it, they give each executive a bonus equal to 25 times the average American’s annual salary. But hey, immediate benefits are high, and another bailout is surely on the way; after all, GM and Chrysler got two.

From GM to AIG, responsibility needs to be shifted back to the individual, not the vague entity as a whole. There are no individual consequences for the unethical practices we’re seeing in these corporations. We’ve been far too trusting of executives who will do anything to turn a profit. We need to create bailout contracts with that in mind, and patch up the holes. Or better yet, we could stop bailouts altogether.

Spencer Merrick