Explained: Biden’s Student Loan Forgiveness Plan

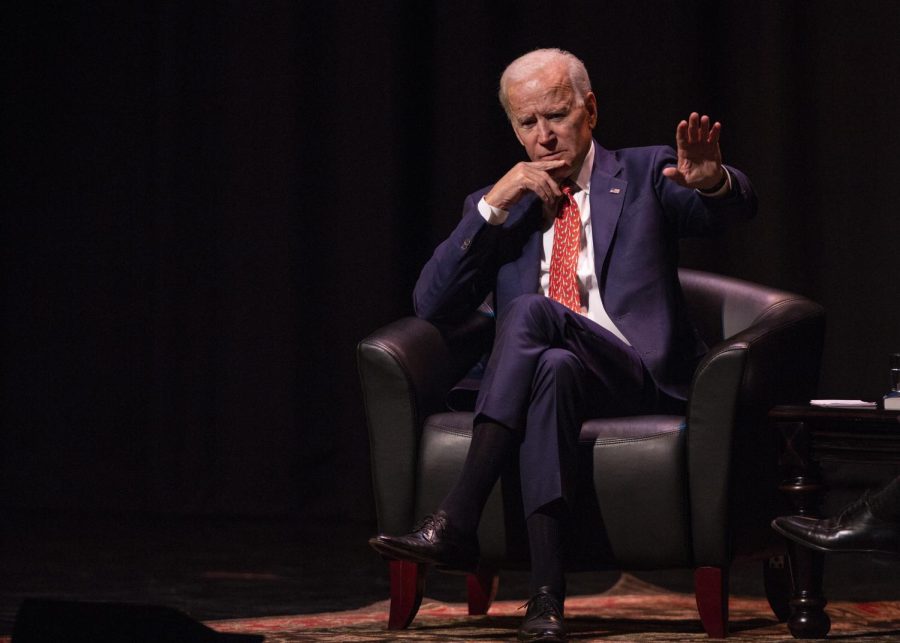

Former Vice President of the United States Joe Biden speaks at Kingsbury Hall on the University of Utah campus on Dec. 13, 2018. (Photo by Justin Prather | The Daily Utah Chronicle)

September 12, 2022

President Joe Biden officially announced his three-step plan to relieve student-loan debt for qualifying borrowers on Aug. 24, 2022.

The amount of debt forgiveness is less than what some Democrats have been pushing for but is a significant step in the direction of his initial campaign promise to forgive all undergraduate tuition-related federal student debt.

The Plan in 3 Parts

According to the White House Fact Sheet, the first part of Biden’s plan is to pause the federal student loan repayment through Dec. 31, 2022. Payments will resume in Jan. 2023. In addition, the Department of Education will provide up to $20,000 in loan relief to those who received a Pell Grant with an individual income less than $125,000 or $250,000 for married couples. Those who did not receive a Pell Grant can receive up to $10,000 in relief.

The second part of Biden’s plan is to cut monthly payments in half for undergraduate loans. This income-driven repayment caps monthly payments on loans at 5% of a borrower’s discretionary income. It also proposes a rule that allows a borrower to receive credit for loan forgiveness if they’ve worked for a non-profit, the military or for local, tribal, state or federal government.

The final part of his plan is to reduce the cost of college and hold schools accountable for any price hikes.

Effect on Economy

Marshall Steinbaum, assistant professor of economics at the University of Utah, said students haven’t been able to make progress toward repayment because they were so overburdened by their student debt before the pandemic repayment pauses.

In addition, Steinbaum said the combination of canceling student-loan debt and ending the repayment pause that has been in place since the pandemic started will affect the economy.

“The combination of those two things will be negative for the macro economy,” Steinbaum said. “The more debt is issued, the less debt is going to be paid back.”

As the United States continues to struggle economically, some have assumed that this plan would contribute to inflation, but Steinbaum disagrees.

“The idea that this will make inflation worse is pretty much a made-up talking point by those people who don’t want to do the student debt cancellation,” he said.

Steinbaum noted there are some obstacles standing in the way for borrowers to get their loan relief.

“There is supposedly an application process which is totally unnecessary, and onerous,” Steinbaum said.

According to the New York Times, Biden’s plan could face a protracted legal fight because “enacting such a major fiscal outlay through emergency executive powers has raised questions about whether Mr. Biden has the authority to carry out such a policy on his own …”

Amount and Resources

Many think the plan, while a step in the right direction, is simply not good enough for borrowers.

Gabriela Merida, political science and ethnic studies sophomore, said she thinks it will benefit students in the long term, but that the government should cancel all student debt.

Steinbaum said the amount of forgiveness is not comprehensive enough.

“It’s not really good enough or not comprehensive enough, because there’s lots and lots of student borrowers that owe more than $10,000 or $20,000 of student loans who are still not going to be able to repay those loans,” Steinbaum said.

According to NPR, critics of the plan have argued its fairness to students who have had to pay off student debt in the past.

“A common sentiment has been: ‘What about those who already paid off their loans? Or didn’t take out loans at all? How is this fair to them?'” Lauren Hodges wrote.

“Try to be empathetic to other people and what they’re experiencing right now,” Merida said. She added this group of people should also be shown empathy because “what they had to go through wasn’t fair either. Maybe that’s even more of a reason to fight for change,” Merida said.

Anthony P. Jones, executive director of scholarships and financial aid, wants U students and alums to be aware of loan forgiveness and other related initiatives.

“We believe it is important to ensure accurate information is available for the U’s former and current students who have student loan debt,” Jones said.

The University Office of Scholarships and Financial Aid website has a small amount of general information and resources to answer any questions students or alums have but they hope to learn more details from the Department of Education soon.

“… We need to know more clearly who qualifies and who doesn’t, and what the process is for applying,” Jones said. “The best place to check on both the amount of federal student loan debt as well as whether they received a Federal Pell Grant at any time is to log in to their Federal Student Aid account at studentaid.gov.”

John Hedberg • Sep 12, 2022 at 5:34 pm

Beware scams coming to you electronically (or by mail), claiming you can sign up for loan forgiveness through their program, then asking you for your personal & financial information.

That said, does anyone really believe the government can just waive a magic wand, and student debt will just “disappear”? The government will be paying off your debt, and that means other taxpayers, millions of whom are a lot less privileged than you are, may end up having to help pay off the loans you agreed to repay. “Cancelling debt” is a euphemism politicians like to use to hide the fact that they’re really taking money from other taxpayers to buy your vote by using other people’s money to pay the debt you agreed to pay yourself.

These politicians should be prosecuted for theft! 😂

I think making universities liable to repay the loans of their unsuccessful graduates would make more sense, since maybe they’d charge less, and teach better, if they have to repay loans for their failed students. Colin Powell (former Secretary of State) did a full year of undergrad at CCNY for less than $150, including books. I’m sorry, but inflation just hasn’t gone up enough to justify a hundred-fold increase in tuitions & fees! The American university system is a scam, and we the people are being robbed of our future opportunities by these parasites (no offense).

Just a thought to consider~

Best, with Love,

J Hedberg