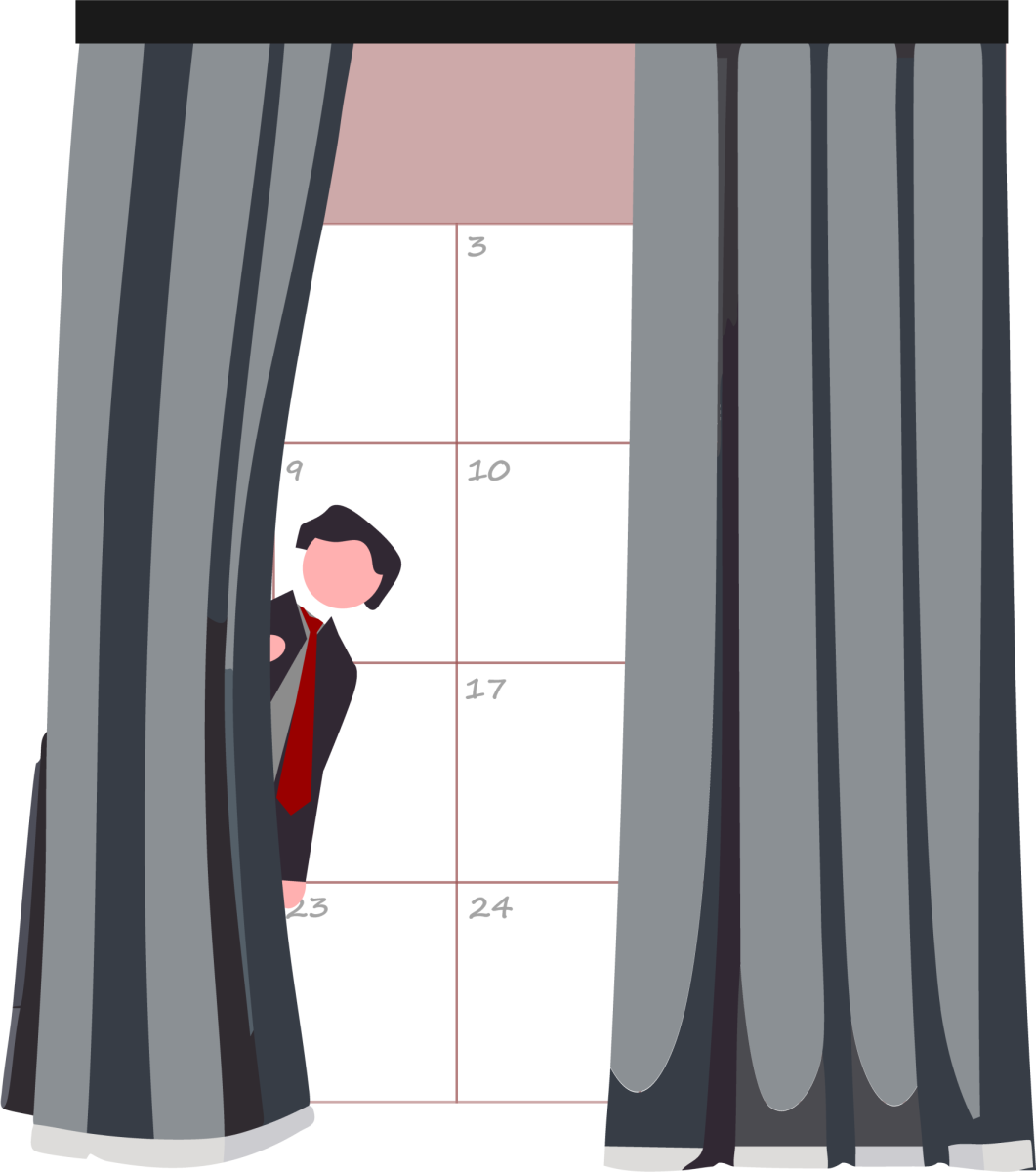

When Donald Trump broke decades of tradition by refusing to release his tax returns before the election, many speculated about whether these returns could contain something politically-damaging. That question got answered this month when The New York Times released pages of Trump’s 1995 state tax returns showing that he registered a $916 million “net operating loss” that could allow him to avoid paying income tax for as much as 18 years. But while such a revelation might lead us to challenge the way Trump conducts business, it also raises fundamental questions about our tax code and how it contributes to income inequality. Trump’s tax returns show us the many ways in which our current system allows the wealthy to pay a disproportionately small share of the cost of running this country.

Although the documents give us unique insight into Trump’s tax history, the idea that he could have avoided paying federal income tax isn’t new. When Hillary Clinton suggested as much during the first presidential debate, Trump interjecting that this made him “smart.” Trump has further confirmed this in the second presidential debate, responding to a question about his use of the rule to avoid income tax with the unequivocal “Of course I do.” Trump went on to say that other business owners take advantage of the same kinds of tax breaks.

There is certainly truth to the claim that other millionaires use some of the same deductions as Trump. The ability of business owners to carry net operating losses into the next year to avoid paying taxes is a very old rule; Trump’s use of it is notable due to the sheer size of his loss, estimated at about 2 percent of all U.S. operating losses that year. Other well-known billionaires, such as Warren Buffett, also make frequent use of tax loopholes in both business and personal income. The fact that Trump felt no shame in his use of the rule helps illustrate the knowledge gap between those who know and utilize the loopholes in the code and those who do not understand the intricacies of it. It also points to the fact that the rich are in a unique position to take advantage of it.

A more detailed look at the provisions reveals just how fundamentally unequal they are. The “net operating loss” laws Trump used to avoid income tax are not available to those earning a set wage, meaning that many low to middle-income Americans that might benefit from carrying over their losses to the next year cannot. Further, most of the deductions Trump uses within the real estate industry only apply to those considered “real-estate professionals,” a title that cannot usually be achieved by a small-time landlord that has a different full-time job.

In a time of rising income equality, we are forced to ask whether or not these tax rules are the kind that can serve America best. Part of the frustration that led to Trump’s popularity came from the feeling that the economic system wasn’t fair and that it benefited some more than others. As we can see through Trump’s own tax returns, however, Trump is in many ways part of the problem. In addition to using these tax rules to avoid income tax, Trump’s tax proposal includes an even further cut on the business tax rate and an end to the “estate tax” that targets the very wealthy.

In the end, this moves beyond policy to our fundamental attitudes about fairness. We want an economy that gives everyone an equal chance even if it doesn’t always result in equal outcomes. Many tax deductions, however, favor business-owners and cannot be used by low or middle-income Americans. The fact that a billionaire could avoid paying income taxes while most Americans continue to be burdened by them illustrates an unfairness, unfairness that is written into the tax code itself. For those who are not as well-off, the rich contributing less and less doesn’t look smart – it looks fundamentally inequitable.